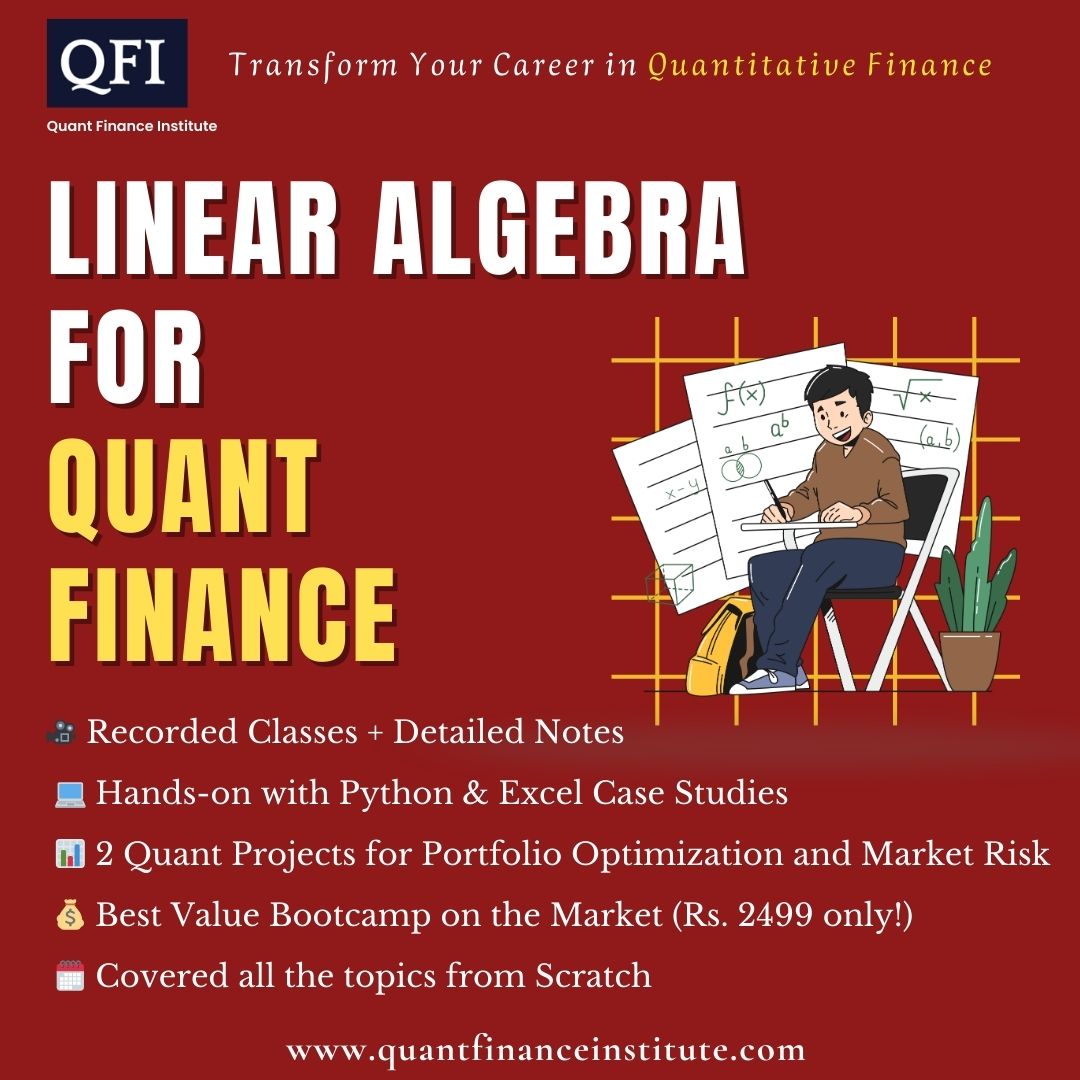

Linear Algebra for Quantitative Finance

Categories: Linear Algebra, Quantitative Finance

About Course

What Will You Learn?

- Master the Foundations of Vector Spaces: Understand vector spaces, subspaces, linear combinations, dependence/independence, and how these concepts apply to data structures in finance.

- Solve and Analyze Systems of Linear Equations: Apply Gaussian and Gauss-Jordan elimination, understand consistency, and interpret the existence and uniqueness of solutions — crucial for portfolio construction and regression modeling.

- Manipulate and Interpret Matrices: Perform matrix operations (addition, multiplication, inverse, transpose) and understand how linear transformations relate to real-world financial problems.

- Compute and Apply Determinants: Analyze invertibility and system solvability using determinant properties, and solve linear systems with Cramer’s Rule when applicable.

- Explore Eigenvalues, Eigenvectors, and Diagonalization: Grasp their significance in financial modeling, especially in Principal Component Analysis (PCA) used for factor risk modeling and yield curve analysis.

- Bridge Theory with Quantitative Finance Applications: Solve real-world problems like yield curve decomposition and optimal asset allocation using core linear algebra techniques.

Course Content

WhatsApp Group

Pls join our whatsapp group using the link in PDF

-

QFI WhatsApp Group

Linear Algebra

-

Linear Algebra (Introduction)

01:12:36

Solve System of Linear Equations (Matrix Method)

-

Matrix (Introduction and Operations)

40:55 -

Solving Linear Equation Using Gaussian Method

01:07:56 -

Solving Linear Equation Using Gauss Jordan Elimination Method

33:26 -

Solve Linear Equation Using Matrix Inverse Method (2X2 Matrix)

01:09:42 -

Solve Linear Equation Using Matrix Inverse Method (3X3 Matrix)

38:46 -

LU Decomposition Method to Solve Linear Equation

37:47 -

Cholesky Decomposition Method

24:33

Vector

-

Vector, Vector Space & Vector Subspace

01:14:06 -

Linear Dependence & Independence, Basis and Rank

38:18 -

Homogenous & Non Homogenous Systems (Solving AX = O & AX = b)

38:29 -

The Four Fundamental Subspaces & Orthogonality

44:41 -

Eigen Values & Eigen Vectors

27:43

Quant Project 1: Mean-Variance Optimization: Foundations of Quantitative Portfolio Construction

-

Mean Variance Optimization (Theory on Return, Standard Dev, Covariance, Correlation, Sharpe Ratio)

47:23 -

Mean Variance Optimization (Excel Implementation)

36:04 -

Building the Efficient Frontier: Concepts and Excel Implementation

21:25

Quant Project 2: Principal Component Analysis (PCA) on Interest Rate

-

PCA on Interest Rate (Theory)

36:41 -

PCA on Interest Rates – (Implementation)

35:53

Request for Certification

-

Request for certification

An organization committed to advancing Quantitative Finance by fostering education, driving cutting-edge research, and promoting collaboration within the financial community.

Pages

Copyright © 2024 Quant Finance Institute (QFI)